The BRICS cryptocurrency name (Brazil, Russia, India, China, and South Africa) is the group of emerging economies that have been gaining increasing attention in recent years. These countries are home to a large and growing population as well as they have significant amounts of natural resources.

In recent days, the BRICS nations have also begun to invest large amounts in infrastructure and technology. The BRICS nations have stepped up in the cryptocurrency space.

Several BRICS-based cryptocurrencies have been launched in recent years, and they are starting to gain traction with financial investors around the world.

In this guide, we will take a look at some of the most popular BRICS cryptocurrencies. This discussion will provide potential benefits to each financial investor and also know more about the involved risks.

What is the BRICS cryptocurrency?

BRICS nation’s cryptocurrency is the digital or virtual currency that is used as a medium of exchange. They are created and controlled using cryptography solutions, which makes them secure and tamper-proof.

BRICS cryptocurrencies are often used to make payments online, but they can also be used to store value or invest.

Some of the most popular BRICS cryptocurrencies include:

BRICS Coin (listed on crypto platforms as BRICS) – This is the most well-known BRICS cryptocurrency. That was launched in the year of 2018 based on the Ethereum blockchain network. That aims to facilitate international trade and cross-border payments between the BRICS nations.

Russia Coin (listed on crypto platforms as RCN) – This cryptocurrency is backed by the Russian Government and is mostly used for international trade. They aim to bypass reliance on the US dollar.

India Coin (listed on crypto platforms as INDC) – This Coin is designed to promote economic development in India. This cryptocurrency seeks to incentivize investments in Indian infrastructure and projects.

China Coin (listed on crypto platforms as CNHC) – It is backed by the Chinese government and is designed to be used for domestic transactions and potentially future international uses.

South Africa Coin (listed on crypto platforms as SAC) – This cryptocurrency is designed to promote financial inclusion in South Africa. They target unbanked populations and aim to facilitate easier access to financial services.

The potential benefits of investing in BRICS cryptocurrencies

There are several potential benefits to investing in BRICS cryptocurrencies. These include:

High growth potential – The BRICS economies are some of the fastest growing in the world. This could lead to a high demand for BRICS cryptocurrencies in the future.

Diversification – Investing in BRICS cryptocurrencies can help you diversify your investment portfolio and reduce your risk.

Inflation Hedge – Cryptocurrencies can be a good hedge against inflation as their supply is limited.

The risks of investing in BRICS cryptocurrencies

There are also some risks to consider before investing in BRICS cryptocurrencies. These include:

Volatility – Cryptocurrencies are highly volatile, which means that their price can fluctuate.

Regulation – The regulation of cryptocurrencies is still uncertain in many countries. This could lead to problems for financial investors in the future.

Security – Still there are cryptocurrencies as vulnerable. It’s important to choose a reliable crypto exchange platform and wallet to store your BRICS cryptocurrencies.

Overall, BRICS cryptocurrencies have the potential to be a good investment. However, it is important to carefully consider the risks before investing any funds.

Brics Cryptocurrency Price

The price of BRICS cryptocurrency can refer to two different digital currencies:

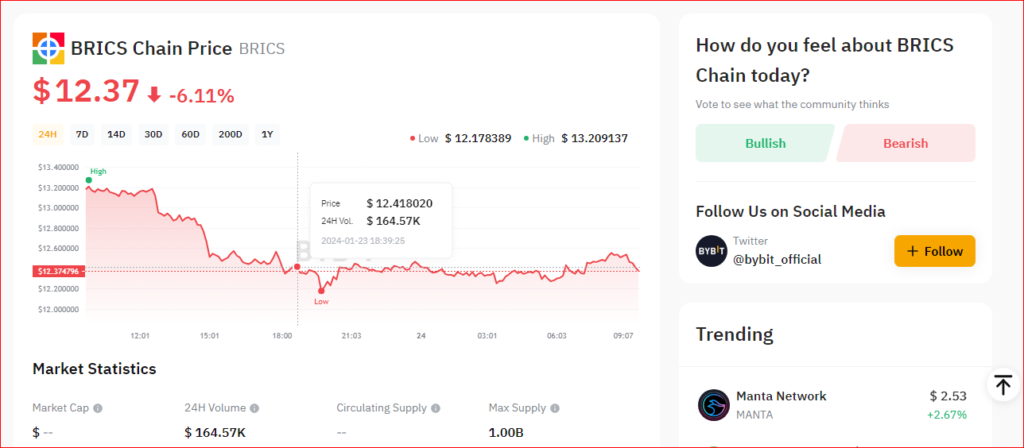

BRICS Chain (listed on crypto platforms as BRICS)

This is the more established and popular BRICS cryptocurrency, with a current price of $12.98 on 23rd January 2024, 15:41IST. It has a 24-hour trading volume of $193.80K and a maximum supply of 1 billion coins.

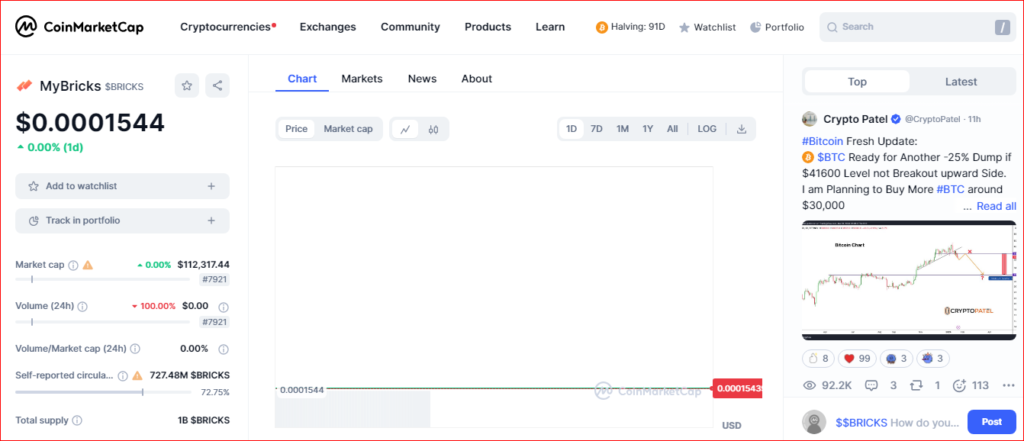

MyBricks (listed on crypto platforms $BRICKS)

This is a much smaller and less active cryptocurrency with a current price of $0.000154 on 23rd January 2024, 15:41 IST. That has an over 24-hour trading volume of $31.39 and a circulating supply of 0 coins.

Additionally, some other cryptocurrencies, while not officially labeled as “BRICS” have connections to one or more BRICS countries.

MyBricks ($BRICKS) – A UK-based project utilizing blockchain technology for real estate investment, with partnerships in select BRICS countries.

Tether (USDT) – While a global stablecoin, Tether operates from Hong Kong, considered a financial hub closely connected to China.

Remember, it’s crucial to research any cryptocurrency before investing, regardless of its connection to BRICS. Each carries its risks and benefits, and careful consideration is essential.

How will BRICS affect the US dollar?

The potential impact of BRICS on the US dollar is a complex and multifaceted issue with ongoing debate and varying opinions.

Potential for weakening the US dollar

Reduced reliance on USD: Increased trade and financial cooperation within the BRICS could lead to a decline in their reliance on the US dollar for international transactions. This could potentially reduce overall demand for the dollar and weaken its value.

Alternative Reserve Currencies: If BRICS Chain or other BRICS-related initiatives gain significant traction, they could potentially emerge as alternative reserve currencies alongside the US dollar. This diversification of global reserve holdings could weaken the dollar’s dominant position.

Factors limiting BRICS’s impact

Dominant USD position – The US dollar currently has a strong global reserve currency due to its stable economy, deep financial markets, and strong legal framework. Replacing this position would require significant time and concerted effort from the BRICS nations.

Internal challenges within BRICS – Each BRICS nation faces its own internal economic and political challenges. Overcoming these challenges and achieving sufficient economic integration within the bloc could be hurdles hindering their global financial influence.

Uncertainty of BRICS Initiatives –The actual implementation and effectiveness of BRICS initiatives like the BRICS Chain are still uncertain. Their long-term impact on the global financial landscape remains to be seen.

Overall, it’s difficult to predict definitively how BRICS will affect the US dollar. The complex interplay of economic, political, and technological factors makes it hard to access the precise timing and magnitude of any potential impact.

Frequently Asked Questions

Bricks can refer to multiple things in the cryptocurrency world. You can consider it as cryptocurrency, specifically referring to the BRICS Chain’s ticker symbol.

Mostly BRICS is used for economic cooperation, promoting development, global governance, cross-border payments, trade settlements, financial inclusion, and investment platforms.

Currently, there are three cryptocurrency backs

Gold-backed BRICS currency – This proposal suggests creating a new reserve currency backed by gold stored by the BRICS central banks.

Basket-based BRICS currency – This idea envisages a reserve currency linked to a basket of currencies from the BRICS nations, similar to the IMF’s Special Drawing Rights (SDRs).

Digital BRICS currency – This could facilitate faster and cheaper cross-border transactions within the bloc.

Conclusion

The BRICS refers to two main cryptocurrencies BRICS Chain (BRICS) and MyBricks($BRICKS). So, you do research before investing in any particular cryptocurrency.